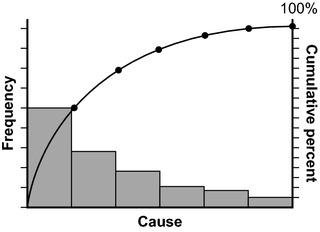

Pareto analysis — is a statistical technique in decision making that is used for selection of a limited number of tasks that produce significant overall effect. It uses the Pareto principle the idea that by doing 20% of work you can generate 80% of the advantage… … Wikipedia

Pareto Analysis — A technique used for decision making based on the Pareto Principle, known as the 80/20 rule. It is a decision making technique that statistically separates a limited number of input factors as having the greatest impact on an outcome, either… … Investment dictionary

analysis — a‧nal‧y‧sis [əˈnælss] noun analyses PLURALFORM [ siːz] [countable, uncountable] 1. a careful examination of something in order to understand it better: • The researchers carried out a detailed analysis of recent trends in share prices. •… … Financial and business terms

Pareto distribution — Probability distribution name =Pareto type =density pdf cdf Pareto cumulative distribution functions for various k with x m = 1. The horizontal axis is the x parameter. parameters =x mathrm{m}>0, scale (real) k>0, shape (real) support =x in [x… … Wikipedia

Pareto principle — The Pareto principle (also known as the 80 20 rule, the law of the vital few and the principle of factor sparsity) states that, for many events, 80% of the effects come from 20% of the causes. Business management thinker Joseph M. Juran suggested … Wikipedia

Pareto, Vilfredo — born July 15, 1848, Paris, France died Aug. 19, 1923, Geneva, Switz. Italian economist and sociologist. Educated at the University of Turin, he worked as an engineer and later served as a director of a large Italian railway. He taught at the… … Universalium

Root cause analysis — (RCA) is a class of problem solving methods aimed at identifying the root causes of problems or events. Root Cause Analysis is any structured approach to identifying the factors that resulted in the nature, the magnitude, the location, and the… … Wikipedia

Vilfredo Pareto — Lausanne School Born 15 July 1848(1848 07 15) Died 19 August 1923(1923 08 … Wikipedia

Cost–benefit analysis — (CBA), sometimes called benefit–cost analysis (BCA), is a systematic process for calculating and comparing benefits and costs of a project for two purposes: (1) to determine if it is a sound investment (justification/feasibility), (2) to see how… … Wikipedia

Cost-benefit analysis — is a term that refers both to:* a formal discipline used to help appraise, or assess, the case for a project or proposal, which itself is a process known as project appraisal; and * an informal approach to making decisions of any kind. Under both … Wikipedia